Free Mileage Log Templates Smartsheet

Apr 13, 2018 mileage logs may also be used to keep track of other deductible miles, such as those related to travel for medical appointments, when moving, or as part of work for charitable organizations. employers may set their own reimbursement rates, while the irs updates mileage rates each year for taxpayers to follow. Jan 7, 2020 while the standard mileage rates for business, medical and moving employees need to use an irs-compliant mileage log but they dont.

15 Vehicle Mileage Log Templates For Ms Word Excel Word

Medical mileage expense form. if you need a medical mileage expense form for a year not listed here, please contact the information and assistance unit at your. The mileiq business mileage tracker frees you from the pain of manually tracking your miles for taxes or reimbursement. mileiq is a free mileage tracking app. Oct 30, 2020 new 2021 irs standard mileage rates for business, medical and moving. trips from personal trips, to keep accurate logs of deductible miles. Now, there are three main categories of mileage deductions: business, medical and moving, and charitable. in this article, were going to cover everything you.

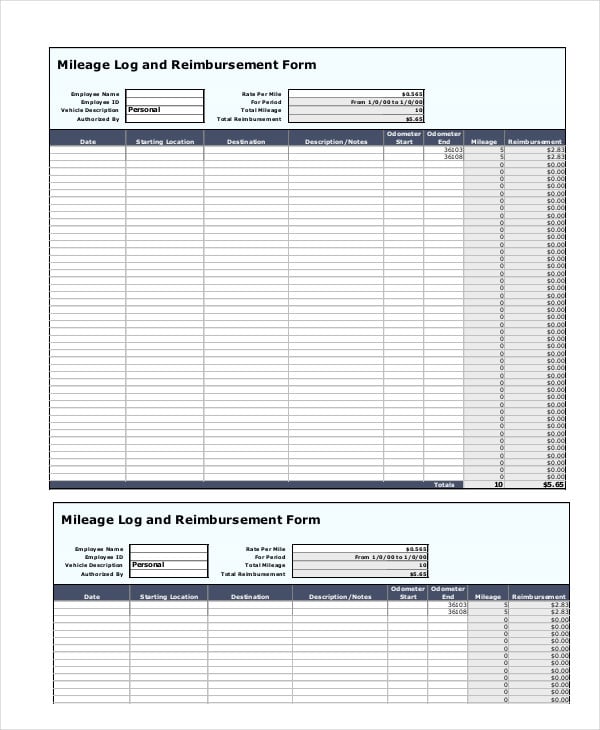

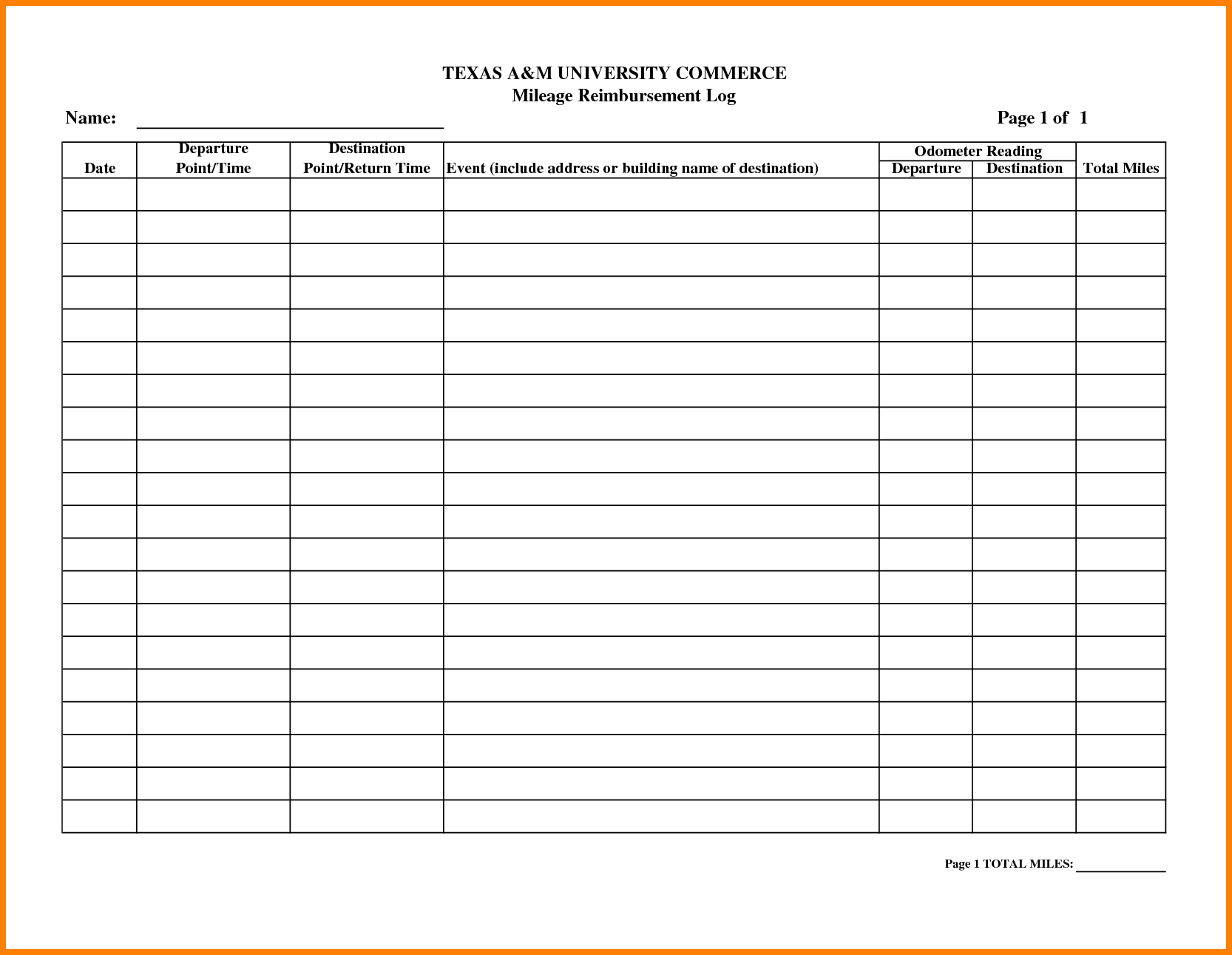

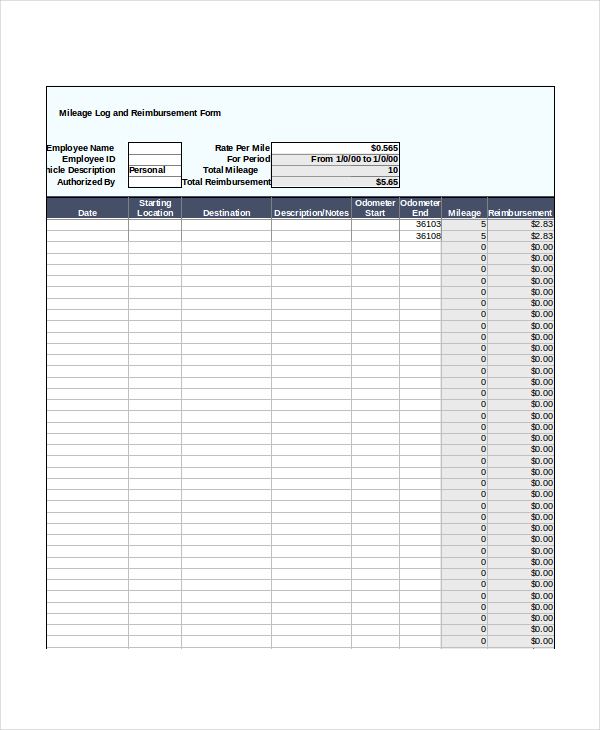

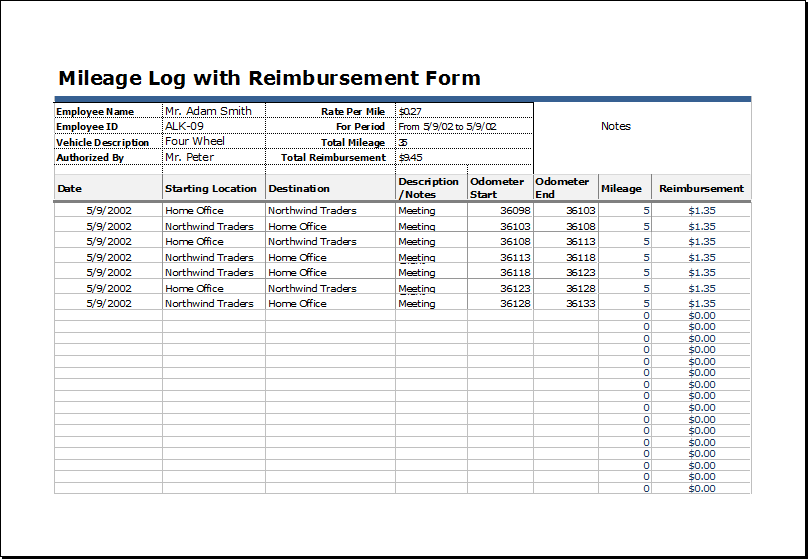

Free mileage log templates (for excel and word).

Mileage Tracker Try Our Automatic Mileage Log Hurdlr

Mileage log records are necessary for any business that wants to make mileage deductions for tax purposes. many business owners simply estimate their business mileage, but it is important to note that the irs looks at mileage deductions closely and you could be audited because of it. A printable mileage log medical mileage log refers to the document you use to keep track of the miles you have driven. this document can be used to file for at least a tax deduction or even a reimbursement. this means that every mile you spend driving to meet clients or to run errands for the company will be given back to you in cash, which will either be deducted from your taxes or reimbursed after your general application.

The internal revenue service has released the 2021 optional standard mileage medical mileage log rates used to calculate the deductible costs of operating an automobile for business, charitable, medical or moving. Irs mileage rates drop for 2021: business, moving, charity, medical you may need to substantiate your deduction by showing a log of the miles you drove. Contents of a mileage log along with a beginning record of the vehicles mileage at the beginning of the year, youll need a record at the end of the year too. this should match with the amounts that are recorded each day to ensure that the mileage is correct.

Medical mileage log requirements. like with business miles, the irs doesnt just take your word for your medical miles. you need documentation of these trips in the form of a mileage log. your mileage log should include a record of: your mileage; the dates of your medical trips; the places you drove for medical purposes; the medical purpose for your trips. Track, calculate, and log your business mileage reimbursement keeping an accurate track of your vehicles mileage could save you big at tax time. so weve created this free mileage calculator to help you deduct the costs of operating a vehicle for business, charitable, medical, or moving purposes on your taxes or to calculate your business.

Free Mileage Log Templates For Excel And Word

The easiest way to keep records is to use a mileage log template that will have spaces for you to record your mileage for each trip you take. the irs has been known to disqualify some deductions because there wasnt a clear separation between driving for business and other trips. mileage log templates. Mileage tracking refers to keeping a mileage log of miles driven for the purpose of tax deduction or reimbursement. for 2020 tax filings that are due in 2021, you can claim a 57. 5-cent deduction per business mile driven. employees often use this same rate. Apr 13, 2018 mileage logs may also be used to keep track of other deductible miles, such as those related to travel for medical appointments, when moving,. Employees often use this same rate on their expense reports to get reimbursed for business trips. personal mileage driven for charity work, medical purposes or .

Mileage tracking refers to keeping a mileage log of miles driven for the purpose of tax deduction or reimbursement. for 2020 tax filings that are due in 2021, you can claim a 57. 5-cent deduction per business mile driven. employees often use this same rate on their expense reports to get reimbursed for business trips. Use the vertex42s mileage tracker to keep track of your business mileage, purpose, and notes. the template will also help you to calculate the amount you are owed. if your company has a specific reimbursement form for you to use, then keep a copy of vertex42s mileage tracking log in your car to track mileage at the source.

The speedometer, mileage counter, fuel log, etc. are all necessary elements of a car or motorcycle that help to analyze the state of the machine. according to many people, mileage details seem rather irrelevant, but there is a reason it is present on dashboards. Medical driving and medical mileage deduction. weve mentioned the agi rate, but the medical mileage deduction rate is something completely different. you are entitled to 16 cents/mile for medical or moving purposes. the rate went down by 4 cents from last year. final words. medical mileage deductions are not to be ignored.

31 Printable Mileage Log Templates Free Templatelab

The following table summarizes the optional standard mileage rates for employees, self-employed individuals, or other taxpayers to use in computing the deductible costs of operating an automobile for business, charitable, medical, or moving expense purposes. Standard mileage rate restrictions: the standard mileage rates may not be used for vehicles used as equipment, or for more than four vehicles used simultaneously. you cannot use the standard mileage rates if you claim vehicle depreciation. instead, a portion of the rate is applied, equaling 27 cents-per-mile for 2020. The first method is the standard mileage rate, whereby the irs sets a specific deduction per mile. the current (starting in 2018) irs standard mileage rate is 54. 5 cents per business mile. the second method involves determining the percentage use of the vehicle for business purposes and multiplying by the total expenses from the use of the vehicle. some of the costs that you may include are. Consider automatic mileage logging with mileiq. to use this mileage log template for excel, you should record all your drives and then transfer to the sheet when youre in front of the computer. if youd like an easier way, consider using a mileage-tracking software like mileiq. mileiq provides automatic mileage logging.

Medical mileage expense form. if you need a medical mileage expense form for a year not listed here, please contact the information and assistance unit at your closest district office of the workers compensation appeals board. Apr 13, 2018 mileage logs may also be used to keep track of other deductible miles, such as those related to travel for medical mileage log medical appointments, when moving, or as part of work for charitable organizations. employers may set their own reimbursement rates, while the irs updates mileage rates each year for taxpayers to follow.

Medical mileage deduction: everything you need to know [2021.

0 komentar:

Posting Komentar